The Paradoxical Development of the Usage of Cash During the Pandemic: Part II

Global Trust in Banknotes during the Pandemic

The acceleration of the paradoxical cashMoney in physical form such as banknotes and coins. More developments during the ongoing pandemic, namely the decline in cash usage at point of sale accompanied by a surge in cash holdings, was addressed in July. The occurrence of the cash paradox itself is not a surprise – the Norges Bank was already paying attention 20 years ago. However, the astonishing fact was that the use of banknotes as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More reached record growth rates, simultaneously as their use in transactions decreased significantly as traditional brickTen straps are commonly called a brick. In other words, a brick is a thousand notes. See Strap. More and mortar store closed and online commerce boomed.

The most striking factor in these developments is the global trust in banknotes during the pandemic. Crisis situations and other uncertainties are often reflected in the demand for the internationally used currencies like the US dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More or euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More. In 2020 the banknotes-in-circulation growth rates were very high even in the case of currencies which have had a poor record regarding the stability of their value.

The study published in July was limited to note circulation in value terms. With more information now available also on the denominational demand, further light can be shed on the developments during the pandemic and the store of value function of moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More.

In the following, the banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More circulation in volume terms will be first addressed and its development in 2020 compared with that in value terms. The denominational demand is analysed with various indicators. Thereafter, the development of the value of banknotes in circulation during the first part of 2021 is considered before concluding with potential implications of the current developments for the future of cash.

Banknote circulation in volume terms

Even if the record growth rates of the value of banknotes in circulation have been good news for the suppliers of banknotes and their raw materials, it is only part of the story from the point of view of the whole banknote community. Note circulation in volume terms offers the following further insights.

First, it is evident that the development of the number of banknotes in circulation (volume) is a more interesting pieceIn plural, it is commonly used as synonym for units of banknotes and coins. More of information than that of their value from the point of view of suppliers. For example, an addition of one million in value terms can consist of 1,000 pieces each of 1,000 units of the local currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More or 100,000 pieces of 10 units respectively.

Second, the use of banknotes in transactions have more impact on the processing and logisticsThe term originates from military language and refers to the movement and provisioning of troops at war. In today’s business vocabulary, it refers to the management in particular, the transportation, storage and distribution of finished goods. More of banknotes. Available data shows that, in the case of several currencies, the developments of the value of banknotes in circulation in 2020 have been the result of both withdrawals from and lodgements to the central banks having decreased significantly. The high growth rates in the value of banknotes in circulation have resulted from a smaller decrease in withdrawals than in lodgements. Both banknote flows having negative growth rates mean that all logistical operations have decreased, which put pressure to the existing cash infrastructure.

Third, volumes also better account for the inflationary effects, which are mirrored in the value of banknotes in circulation.

In view of these considerations, the volume information is more interesting than ever. The drawback is, however, that the available data is globally not as comprehensive as in the case of information in value terms.

On the positive side, more and more central banks publish data on banknote operations like withdrawals and lodgements of banknotes and even on their processing and destruction, but for some reason the denominational structure of the value of banknotes in circulation is not published. This information is definitely available in the central banks. Hopefully, the current developments regarding the two motives to use cash will encourage more central banks to increase transparency in this respect.

With the generous support of several central bank colleagues, the publicly available data have been able to be complemented with figures for a number of additional currencies. Accordingly, the annual growth rates of the number of banknotes in circulation was available from 99 currencies (in comparison to 140 currencies in value terms). Figure 1 addresses the distributions of these 99 currencies in 2019 and 2020.

Fig 1: Annual growth rate by the number of banknotes in circulation of 99 currencies in 2019 and 2020

Fig 1: Annual growth rate by the number of banknotes in circulation of 99 currencies in 2019 and 2020

A few interesting conclusions can be drawn on the basis of Figure 1.

First, it shows that opposite to that in value terms the distribution of growth rates in volume terms in 2020 is not very different from a ‘normal’ year. However, even if the shapes of the distributions in 2019 and 2020 are quite similar, the growth rates are on average significantly higher in 2020 than in 2019. Just as with value terms, the distribution in 2020 has moved to the right. The median annual volume growth was 10% in 2020 (5.5% in 2019). Furthermore, the number of currencies which had a negative growth rate in volume terms more than halved in 2020.

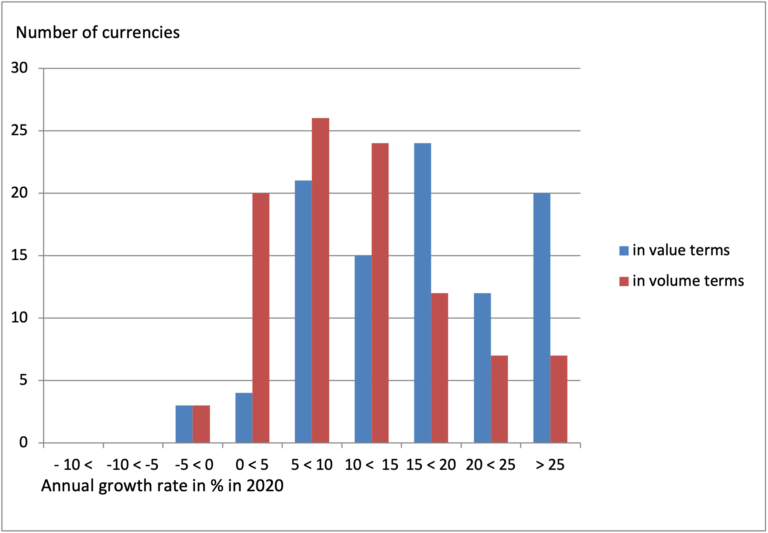

It is also interesting to compare the growth rates both in value and volume terms, again limiting the study to those 99 currencies, for which both figures are available. The respective distributions are depicted in Figure 2.

Fig 2: Annual growth rates by the value and number of banknotes in circulation of 99 currencies in 2020.

Fig 2: Annual growth rates by the value and number of banknotes in circulation of 99 currencies in 2020.

Figure 2 shows that the volume growth, even though exceptionally high in 2020 (median growth rate 10%, see above), was on average much lower than the growth in value terms (median growth rate 16.6%). Therefore, the demand has generally concerned the high denominationEach individual value in a series of banknotes or coins. More banknotes. This is an additional confirmation that the store of value function of money, for which the higher denominations are mainly used, has been the major driver of the demand for banknotes.

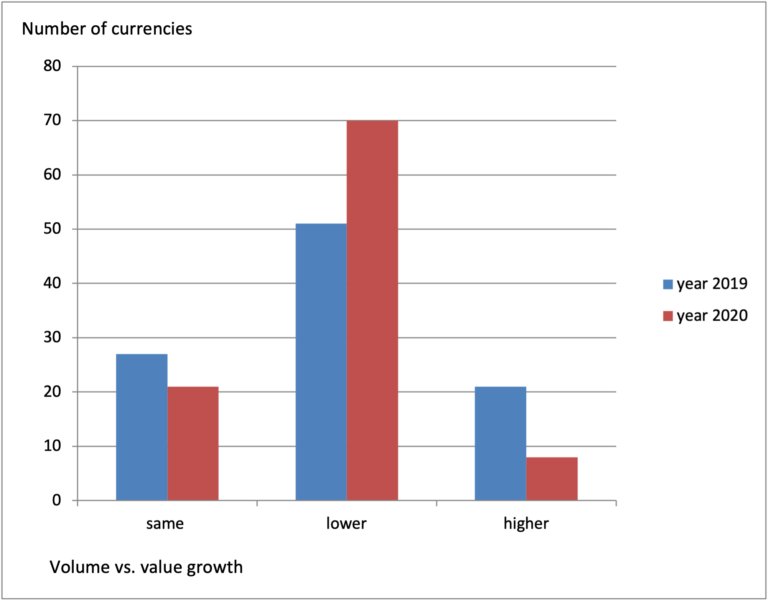

This can be demonstrated also by another indicator. In Figure 3 the currencies under consideration are divided in three groups: 1) the annual volume and value growth rates are within a narrow range (15%) (called the ‘same’); 2) the annual banknote volume growth is at least 15% lower than the value growth; and 3) the volume growth is at least 15% higher than the value growth. When comparing the years 2019 and 2020 in this respect it is evident that the volume growth being lower than the value growth is more significant in 2020.

Fig 3: Banknote circulation volume vs value growth of 99 currencies in 2019 and in 2020.

Value of Banknotes in Circulation during the first part of 2021

In view of the exceptional growth rates of the value of banknotes in circulation in 2020, the further development attracts great interest. Most central banks publish monthly – if not necessarily the value of banknotes in circulation then at least the variable ‘currency outside banks’, followed for monetary policy purposes. Although the figures used are not fully consistent, they provide good indications of recent developments.

In order to have as comprehensive sample of currencies as possible, and in view of the fact that the publication schedules of central banks vary, the figures refer to the end of June 2021. Figure 4 depicts the annual growth rates of the value of banknotes of 112 currencies at the end of June 2021 compared with that at the end of 2020.

Fig 4: Annual growth rate by value of banknotes in circulation of 112 currencies at end of December 2020 and June 2021.

Before drawing any conclusions two aspects should be emphasised.

First, the pandemic still creates uncertainty almost everywhere, but the situation varies more than in 2020 because the vaccination has developed very heterogeneously. At the same time when in some countries the restrictions have been relaxed, in some others the pandemic is at its height with record numbers of infections.

Second, when considering annual growth rates in June 2021, they evidently depend on the situation in June 2020. In some countries the pandemic started to raise concerns only during the latter part of 2020, while in others the highest uncertainty and steep rise in the demand for banknotes occurred already in Spring 2020.

Then to some provisional thoughts regarding Figure 4. The situation is clearly more heterogeneous than it was at the end of 2020. It seems that in many countries the annual growth rates have started to stabilise and the shape of the distribution of currencies according to their annual growth rates has moved closer to a normal situation. However, the value of banknotes in circulation is still above its trend before the pandemic.

Concluding remarks

The analysis of the volume development of banknotes in circulation in 2020 has confirmed the general picture that already emerged on the basis of the development in value terms. Very few currencies had a negative volume growth rate in 2020, and half of the currencies had even a double-digit volume growth.

At the same time, the statistics depicted in Figures 1–3 indicate that the development seen during recent years – namely that the volume growth of banknotes in circulation is lower than that in value terms – accelerated in 2020. On average the banknote demand is dominated by middle and high denomination banknotes and based on the store of value function of money.

The results also demonstrate that the demand for high denomination banknotes is based on precaution under uncertainty, contrary to the often presented suspicious black-and-white view on reasons for their demand.

The development during the first half of 2021 already gives certain indications as to what will happen next. Particularly in countries in which the restrictions introduced during the pandemic are relaxed, the annual growth rates of the value of banknotes in circulation will stabilise. The recent record growth rates may turn to negative in approaching the new normal, evidently depending on how the public will behave with their higher than normal cash balances.

The decrease in the transactional volumes has put pressure on the cash infrastructure. The central banks and other stakeholders in the cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More should find solutions to avoid its deterioration. As underlined in the article published in June, a functioning cash infrastructure in normal times is a prerequisite for its operational capability and resilience in a future crisis.

In that sense many central banks which are actively researching the potential for the central bank digital currency (CBDC)A digital payment instrument, denominated in the national unit of account, and a direct liability of the central bank, like banknotes. A general purpose CBDC can be used by the public for day-to-day payments like cash. More consider that it should replicate as much as possible the properties of physical cash. The lesson of the ongoing pandemic is that one shouldn’t forget in this respect the store of value function of cash for the wellbeing and security of citizens.

In the public consultation on digital euro organised by the ECB, the most important features for households and firms were privacy, security and broad usability. All these are characteristic features of physical cash. If they would be described with one word, it would be ‘trust’, trust in privacy, security and usability in all circumstances. This trust makes cash the store of value safety net. Not an easy task to replicate in digital form.