U.S.: Payment Habits of the Financially Included

How the 81.5% Transact: The Banked Population

The U.S. Federal Deposit Insurance Corporation (FDIC) has conducted the National Survey of Unbanked and Underbanked Households with the U.S. Census Bureau since 2009. Per the latest FDIC survey published in November 2022, 107.9 million households (81.5%) were “fully banked” in 2021, meaning that the household was banked and did not use nonbank transactions and credit products or services.

Methods for Accessing Bank Accounts

In 2021 (FDIC 2022: 4), most banked households access their bank accounts through a mobile phone (43.5%), a computer or tablet, i.e. online banking (22%), an ATM or bank kiosk (16%), bank tellers (14.9%), and the telephone (2.9%). The increase in the use of mobile and online banking channels increases the risks for bank customers to fraud and crimes.

Chart 1. United States: Primary Method of Bank Account Access of Banked Households, 2017-2021 (Percent)

Source: FDIC (2022: 4).

The Covid-19 Pandemic

The survey took place in June 2021 (15 months after the Covid-19 pandemic began), evidencing changes in bank account ownership and methods to access bank accounts (FDIC 2022: 3-4):

- The share of recently banked households since March 2020 (4.2%) is slightly lower than the combined shares of the longer-term and the recently unbanked (4% and 0.5%, respectively).

- The main reasons for opening a bank account for the recently banked households were receiving government unemployment benefits or pandemic stimulus payments (34.9%) and starting new jobs (6.3%).

- One in five recently unbanked households reported that losing or quitting a job, being furloughed, having reduced hours, or experiencing a significant income loss contributed to closing a bank account.

- In-person banking declined, as 21% of households used bank tellers, and 19.5% went to the ATM or bank kiosks in 2019. Seniors, lower-income, less-educated, and rural households use in-person banking channels more often.

- The use of mobile banking channels grew sharply from 34% in 2019 to 43.5% in 2021.

Paying Bills and Receiving Income

In 2021, almost all banked households (97.1%) used their bank accounts to pay monthly bills or receive income from work, retirement, or a government agency (FDIC 2022: 47). Three in four (75.2%) exclusively used their bank accounts for paying bills and receiving income.

- Lower-income, less educated, younger (15-24 years), Hispanic, and unemployed households used their bank accounts to pay bills and receive income less than other households.

- Households that primarily used ATMs or bank kiosks to access their bank accounts were likelier to use prepaid cards, moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More orders, or money-transfer services than households that primarily used bank tellers, online banking, or mobile banking.

Chart 2. United States: Methods Banked Households Used to Pay Bills or Receive Income, by Primary Method of Bank Account Access, 2021 (Percent)

Source: FDIC (2022: 48).

The FDIC survey evidences the importance of preserving bank branches and ATMs for sizable sectors of the population who still access financial services in person.

Prepaid Cards and PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More Apps

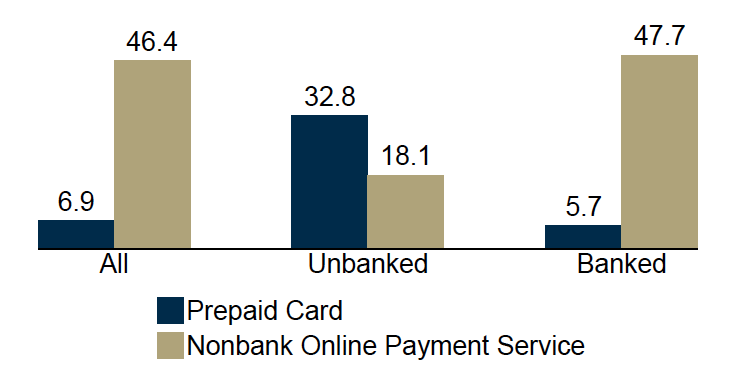

In 2021, 6.9% of all households used prepaid cards all the time (FDIC 2022: 3-4). Unbanked households were more likely to use prepaid cards for paying bills, receiving income, saving, sending or receiving money, and making online purchases (see Graph 1).

Graph 1. United States: Use of Prepaid Cards and Nonbank Online Payment Services by Account Ownership, 2021 (Percent)

Source: FDIC (2022: 4).

Regarding mobile payments, almost half of all households (46.4%) used online payment services from nonbank providers such as PayPal, Venmo, and Ca$h App. Nearly three in four banked households with online payment services (74.1%) linked them to their bank accounts. (FDIC 2022: 3-4). These figures suggest the adoption of mobile payments is not as widespread as the digital payments lobby triumphally announces, even among U.S.-banked families.

Making In-Person and Online Purchases

Nine in ten banked households (89.6%) made purchases in person or online using bank accounts, online payment services, prepaid cards, and money orders (FDIC 2022: 50). The survey did not ask whether they used cashMoney in physical form such as banknotes and coins. More or credit cards.

- Most banked households used their bank accounts for in-person and online purchases (80.6% and 71.2%, respectively).

- Lower-income households were less likely to use their bank accounts or online payment services to make in-person and online purchases.

Sending or Receiving Money

Nearly half of the banked households (48%) used bank accounts, online payment services, prepaid cards, money orders, and money transfer services to send or receive money from family and friends in the United States and abroad in 2021 (FDIC 2022: 51-52).

- Banked households aged 34 or younger (65.7%) and Asian-banked households (61.8%) used these methods at higher rates than other households.

Saving or Keeping Money SafeSecure container for storing money and valuables, with high resistance to breaking and entering. More

Five in six banked households (83.8%) used bank accounts, online payment services, or prepaid services to save or keep money in a safe place (FDIC 2022: 52, 55).

- Most banked households (83%) used their bank accounts to save money; smaller shares used online payment services (10.6%) and prepaid cards (1.5%).

- A lower share of Black banked households (76.5%) used bank accounts to save or keep money safe than households of other races and ethnicities.