UK: Consumers Call for Government Help in Protecting Access to Cash

76% of Consumers think that Government Should do More to Ensure Access to Cash

New research published by Financial Consultants Enryo concludes that three quarters (76%) of UK consumers think that the Government should do more to help people continue to have access to their cashMoney in physical form such as banknotes and coins. More if ATMs and bank branches close, that is. The highest percentage figure is to be found in Scotland where 80% of people think the Government should do more to protect access to cash. The research comes as the Government’s consultation period on the future of cash comes to an end (see Editors’ Notes).

As more rural bank branches and ATM’s face closure, the research also highlighted that almost 4 in 10 consumers (37%), would support the Government introducing legislation which would prevent shops and businesses from refusing cash as a form of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More for day-to-day goods and essential services.

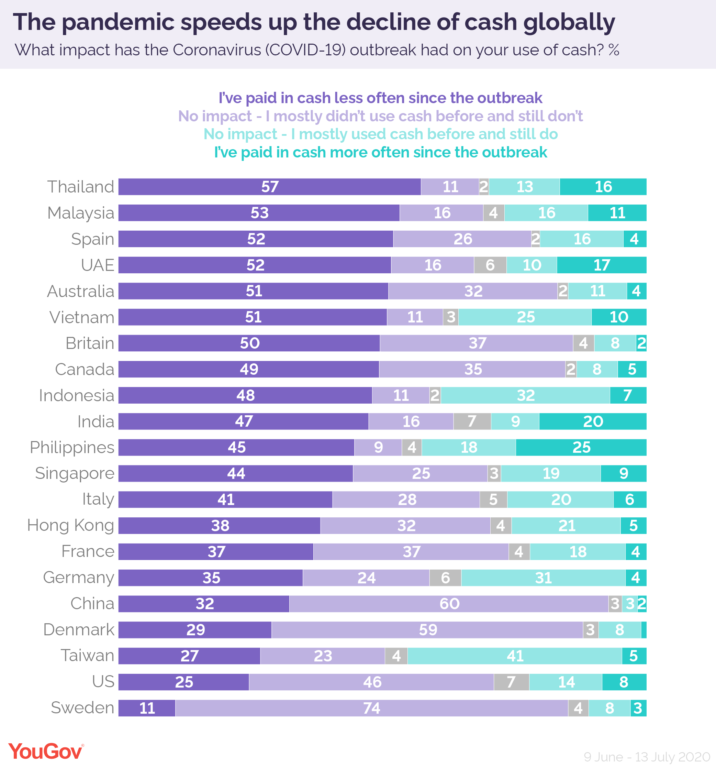

Half of Britons used less Cash as a Result of Covid-19

According to a YouGov survey of 21 countries, Britain has seen one of the largest declines in cash use because of the pandemic. Half of Britons (50%) used fewer notes and coins as a result of COVID, while 37% already mostly paid digitally. Only 8% of the public who usually pay in cash say their habits remain unchanged.

In another recent study by Enryo, it was found that:

Three in five consumers (61%) agree that shops and businesses that encourage payment for goods and services by card, are excluding people who prefer to pay by cash.

A quarter of respondents (26%) said that if a restaurant or shop no longer accepted cash they would no longer shop there (scoring 6+ out of 10 on the agreement scale).

Over the past four weeks compared to before the Coronavirus outbreak, a quarter (24%) of people have experienced situations where they would prefer to use cash, but instead used a card as the place they were in discouraged cash payments.

Over the past year the move towards a cashless society has accelerated. Covid-19 has played its part as more and more shops and businesses now refuse to accept cash as a payment methodSee Payment instrument. More. However, there’s a real risk that as cash usage continues to decline, millions of people will be left behind. Many of these people are the elderly, the vulnerable or the financially excluded who depend upon cash as their primary payment method or they simply don’t have the capability, or access to, digital payments.

“Access to cash is a very emotive subject – everyone has a view. However, this research shows that a growing number of people throughout the UK now want the Government to not only protect their access to cash, but they also want to ensure that cash continues to be an accepted payment method for everyday goods and services.” said David Fagleman, Director at Enryo.

Government Outlines Approach to Protect Future of Cash

On 15 October, the government announced plans to to protect the UK’s future cash system and ensure people have easy access to cash.

Under the government proposals, cashback without a purchase – which has previously been called cash-in-shopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More by the European Payments Council – could be widely available from retailers of all sizes in local communities across the UK. Last year, consumers received £3.8 billion in cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More when paying for items at a till – making it the second most used method for withdrawing cash in the UK behind ATMs.

Harness the same Creative Thinking that has Driven Innovation in Digital Payments

John Glen, Economic Secretary to the Treasury, said: “We know that cash is still really important for consumers and businesses – that’s why we promised to legislate to protect access for everyone who needs it. We want to harness the same creative thinking that has driven innovation in digital payments to maintain the UK’s cash system and make sure people can easily access cash in their local area.”

To ensure no one is left behind by the transition to digital payments, the government announced at the March 2020 Budget that it would legislate to protect access to cash and ensure that the UK’s cash infrastructure is sustainable in the long-term.

The proposals, also include making the Financial Conduct Authority (FCA) responsible for ensuring the cash system benefits consumers and SMEs, are the latest step in the Government’s effort to support the millions of people and business who rely on cash day to day. At present, The Bank of England, Financial Conduct Authority, Payment Systems Regulator, and HM Treasury each have specific roles and responsibilities for oversight of the cash system.

Call for Evidence on Access to Cash

It has been over 18 months since the Access to Cash Review published its final report, concluding that the UK was not ready to go cashless. A call for evidence opened on 15 October 2020 and runs until 25 November 25 . It seeks views on how to ensure industry continues to offer ways to withdraw and deposit cash, how to improve cashback, what affects cash acceptance, and where regulatory responsibility should sit.