Who is Framing Cash?

Advocates of a cashless society tend to fall into three distinct camps: the alchemists, the law and order camp, the fintech alliance

In 2017, Yves Mersch, Member of the Executive Board of the ECB wrote: “Advocates of a cashless society tend to fall into three distinct camps. The first camp, the alchemists, wants to overcome the restrictions that the zero lower bound (ZLB) imposes on monetary policy. The second, the law and order camp, wants to cancel the primary means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More for illicit activities. And the third camp, the fintech (financial technology) alliance, anticipates major business opportunities arising from the elimination of the high storage, issuance, and handling costs of cashMoney in physical form such as banknotes and coins. More that the financial industry currently faces.”

In the early stages of the Coronavirus pandemic, numerous misleading reports and articles advised against using cash claiming that banknotes and coins could be vectors in the spreading of the virus. This provided a golden opportunity for the anti-cash lobbies to speak up.

Bank of America CEO: “We Want a Cashless Society”

In June 2019, Bank of America CEO Brian Moynihan kicked off Fortune’s inaugural Brainstorm Finance conference and declared “We want a cashless society.” It is telling that Moynihan chose to make the statement at a Fortune conference. The magazine was founded in 1929 in the wake of the Great Depression and claims in its 1929 prospectus for advertisers that Fortune should be “the Ideal Super-Class Magazine” for “wealthy and influential people.”

Moynihan added that “We have more to gain [from a cashless society] than anybody from a pure operating costs [perspective].” Bank of America operates 4,300 branches and 15,900 ATMs but has also spent “probably spent $30 billion on code” over the past eight years to develop and improve its technological infrastructure. Running an ATM is roughly estimated to cost $30K per annum which amounts to $477 million for BofA’s estate. That’s almost eight times less than the $3.75 billion invested in IT each year.

PayPal CFO: “The death of cash has arrived”

In July 2020, in a call presenting the quarterly revenues, PayPay executives cited the death of cash as the company posted record earnings. According to CNBC, PayPal CFO John Rainey said: “The death of cash has arrived.” Company executives said society has reached an “inflection point” when it comes to the “death of cash,” and noted that 70% of consumers now fear for their health when it comes to paying in stores. PayPal claim that the demise of cash is due to the digitization of payments and the growth in mobile devices. This creates an opportunity for PayPal to expand its services to those who are unbanked or under-banked say the executives. However, in October 2019, PayPal withdrew from the LibraAssociation, the facebook-driven initiative to design a virtual blockchain-based digital currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More, also with the aim of creating a more inclusive financial system.

This is not the first time that cash is in the crosshairs of PayPal. In 2016, PayPal paid millions of dollars for an ad during the Super Bowl, the final of the American National Football League. The ad was called “There’s a new money in town”. The narrative stated that “Old moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More is these people” while pictures displayed portraits of historic figures illustrated on US and Canadian currencies. It continued with “New money is all people” with a sequence showing people of both genders and diverse ethnic origins. Of the 60 broadcasted ads, PayPal’s was ranked 53rd.

Reinterpreting Gresham’s Law

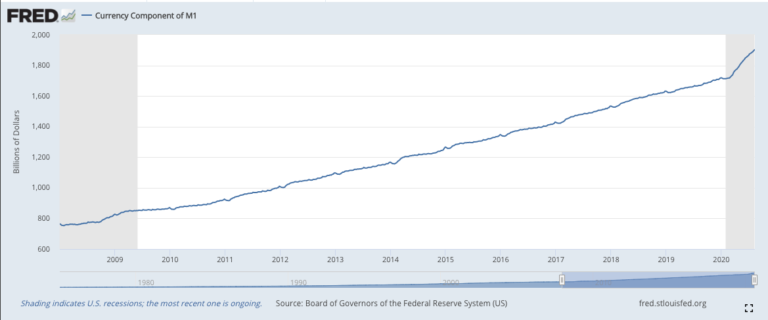

But Paypal is missing a crucial point. While there has been a decline in the use of cash as a payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More during the pandemic in many countries, the overall demand for cash has experienced an unprecedented growth. In the US, at the end of July, the year-on-year growth of the value of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More reached almost 14% or $228 billion. Other countries have experienced similar surges including Argentina, Australia, the Euro-area, and Russia. This is largely due to consumers increasing their cash holding as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More. Perhaps this is a new interpretation of Gresham’s law ‘bad money drives out good’. During the pandemic, consumers have paid more with ‘bad’ digital instruments, but have stored more in ‘good’ cash.

Coronavirus is speeding up the disappearance of cash

In April, Gary Cohn a former banker and former director of the US National Economic Council during the Trump presidency published an op-ed in the Financial Times boasting “For the past five weeks, I have not touched a single coinA coin is a small, flat, round piece of metal alloy (or combination of metals) used primarily as legal tender. Issued by government, they are standardised in weight and composition and are produced at ‘mints’. More or banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More, instead relying exclusively on electronic payments systems and credit cards that only I touch.’ The article argues boldly in favour of digital currencies which according to the author would increase financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More, reduce tax evasion, and limit disease transmission. In the initial version of the op-ed – edited since – Mr. Cohn omitted to mention that since he left the White House, he serves on the Board of a company developing biometric blockchainAn unchangeable digital record where transactions are processed and verified by a network of independent computers rather than by a single referee. This decentralised structure has been described as an open distributed ledger. It supposedly enhances security as there is no single entity to be hacked. It also protects personal identity and guarantees that governments can’t block transactions or otherwise manipulate the payments space. The blockchain is the underlying technology supporting most ... More technology for communications and digital payments and advises fintech companies.

Financial Privacy is a Human Right

The article recognizes that “there are privacy implications to the government having access to individual and corporate wallets” but does not propose a solution. For Alex Gladstein, Chief Strategy Officer at the Human Rights Foundation, a healthy democracy needs financial privacy. If all our behaviours and all our movements are tracked, this can damage democracy in a fatal way. Bank statements say more about what we are doing than our social media accounts or our emails. Economist and Fed Research Fellow Charles Kahn agrees: “Policymakers now fully recognize the importance of privacy considerations in financial infrastructure, including payments arrangements.” The IMF also recognises the importance of privacy in payments; in a recent paper on central bank digital currencies, it underlines that the ability to make anonymous transactions is an important criterion for a payment instrument. The paperSee Banknote paper. More states: “In designing money, national authorities already face a trade-off between satisfying legitimate user preferences for privacy and mitigating risks to financial integrity.”