Argentina: Cash and Inflation

Spending CashMoney in physical form such as banknotes and coins. More as Fast as Possible

With inflation reaching 100%, consumers spend their Argentine pesos (ARS) as quickly as possible, purchasing home appliances in instalments (betting the peso’s value will keep falling) and hardly using credit.

- “Here, if you don’t see the moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, nobody signs anything. After the number of crises we’ve been through, let’s just say you get used to it,” said Eduardo Rabuffetti, a property developer in Buenos Aires.

- “The last installment I paid for the TV or the fridge cost two or three McDonald’s combos. Buying stuff is how you beat inflation,” said Ignacio Jauand, a 34-year-old publicist.

- “When I think of my savings in pesos, I say, ‘Let’s pay for a trip, let’s renew something in the house, let’s buy stuff.’ Otherwise I feel like I’m losing money every day by keeping it in the bank,” said Eduardo Levy Yeyati, an economist.

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More and ATM Withdrawals

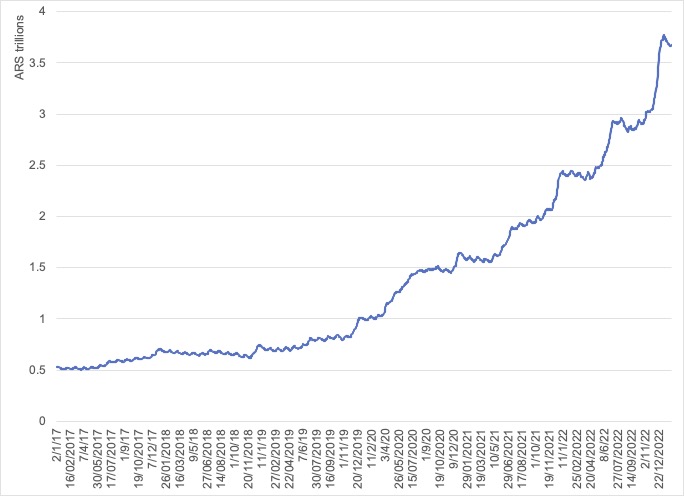

Cash in the hands of the public has increased rapidly since late 2019, according to the Central Bank of the Argentinean Republic (BCRA) figures. At the onset of the Covid-19 pandemic, banknotes and coins in the hands of the public spiked sensibly. They have continued rising since (see Graph 1).

Graph 1. Argentina: Cash in the Hands of the Public, 2017-2022 (ARS trillions)

Source: BCRA Variables (2023).

ATM withdrawals increased between 2017 and 2021, with seasonal spikes each year in December (see Graph 2). The value of ATM withdrawals has increased sensibly in the same period, owing to the rising cost of living and the decreasing purchasing power of cash.

Graph 2. Argentina: ATM Withdrawals, 2017-2022 (Millions of transactions, ARS billions)

Source: BCRA Retail Payments Report (December 2022).

Payments Mix and Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More

In 2021, cash was the most used payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More in point-of-sale transactions in Argentina (with 33.8%), followed by debit cards (23.8%) and credit cards (23.5%), according to FIS Global Payments Reports.

According to the World Bank’s Global Financial Inclusion Database, in 2021

- 92% of Argentines (age 15 and older) owned a mobile phone.

- 71.6% of Argentines had a financial institution account, up from 52% in 2014.

- 54.9% owned a debit card, but only 28.9% had a credit card.

- 65% had made or received a digital paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More.

- In 2017, 9.8% used a mobile phone or the internet to access a financial institution account.

Cash Denominations and Inflation

The BCRA launched the ARS1,000 banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More in 2017. That banknote with the highest denominationEach individual value in a series of banknotes or coins. More is now worth just USD2.70 in the black market. While the BCRA last launched new banknotes in 2016, the Argentine government announced it would issue new banknotes in 2021. The central bank has retired banknotes with small-value denominations to prioritize printing banknotes with higher-value denominations.

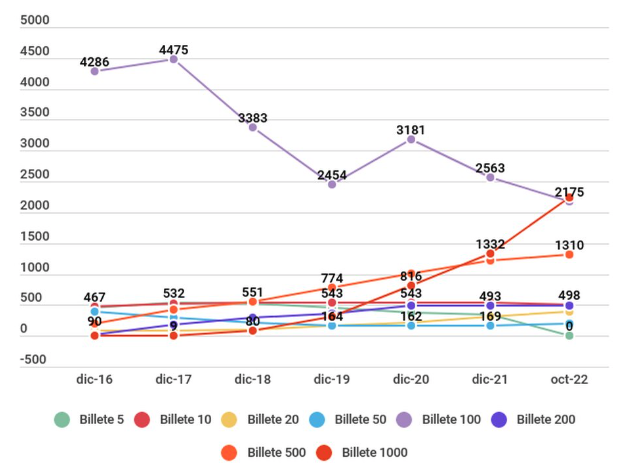

The ARS1,000 banknotes have become the most used in the country. By volume, ARS1,000 banknotes surpassed ARS100 notes in circulation in October 2022 (see Graph 3). Early in February 2023, the BCRA announced it would issue a new ARS2,000 banknote with an official value of USD11.

Graph 3. Argentina: Banknotes in Circulation by Denomination, 2016-2022 (Millions)

Source: Bloomberg Línea (2022).

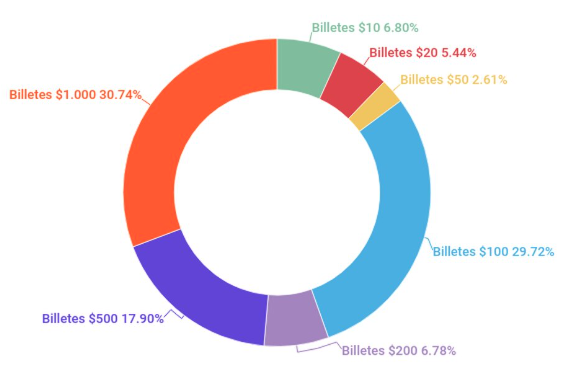

By percentage, ARS1,000 banknotes represent 30.7% of all banknotes circulating in Argentina; ARS100 banknotes reached 29.7%, and ARS500 banknotes represent 17.9% (see Graph 4).

Graph 4. Argentina: Banknotes in Circulation by Denomination, October 2022 (Percentages)

Source: Bloomberg Línea (2022).

The Pro-Digital Payments Lobby

“Digitalizing cash is very positive because it allows people to enter the formal financial system. It is the door to financial inclusion and the first step to increase the use of financial services such as cards, investments and loans.” – Martin Bellocq, Chief Marketing Officer of Ualá.

The Argentine government promoted digital payments during the Covid-19 pandemic, arguing they provided “a better control of expenses, are safer and more convenient, and a credit history that makes it easier to get credit from banking and financial entities.”

The Association of Argentinean Banks (ADEBA) has implemented a strategy to substitute cash with digital money (Iniciativa Dinero Digital en Argentina). ADEBA argues that cash comes with increased printing, management and logisticsThe term originates from military language and refers to the movement and provisioning of troops at war. In today’s business vocabulary, it refers to the management in particular, the transportation, storage and distribution of finished goods. More costs.

“The creation, transfer, utilization, processing, sortingProcess of fitness sorting of banknotes by their condition of use. Through this process, used banknotes are classified as fit or unfit to return into the circulation. See Processing of banknotes. More, storage and destruction of paperSee Banknote paper. More money has a high economic cost for society. In addition, this generates insecurity due to theft from individuals and companies with the aim of taking the banknotes, which have little traceabilityThe tracking of a product through its industrial or commercial life, by monitoring its location at all times. More. The intensive use of cash is detrimental to financial inclusion, as it does not allow its users to users to generate a ‘credit and financial history’ and does not increase the lending capacity of the financial system. Finally, it has been demonstrated that the use of physical money has a relevant ‘carbon footprint’. All these costs are substantially lower when it comes to digital money.” – ADEBA (2022: 3)

ADEBA argues that digital payments could increase fiscal revenues and enlarge the formal economy in Argentina if the government limits cash transactions and forces consumers to pay with debit cards.

Dollarization and Barter

Argentina is heavily dollarized. Middle-class and wealthy Argentines use U.S. dollars to pay for big purchases (land, houses, cars, artworks) and keep their savings in dollars, hidden inside their homes or in safeSecure container for storing money and valuables, with high resistance to breaking and entering. More deposit boxes.

While the government restricts citizens from buying more than $200 in U.S. currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More monthly, the black market thrives, moving $3-$4 million daily.

Foreign tourists visiting Argentina avoid paying with cards, as the official dollarMonetary unit of the United States of America, and a number of other countries e.g. Australia, Canada and New Zealand. More exchange rateThe rate at which one currency will be exchanged for another. More used for card transactions is much lower than the “blue dollar” changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More rate prevailing in the black market.

Working-class Argentines rely on “trueque” clubs (bartering exchanges) to swap goods without using money. Participants use “créditos” (credit tickets), currencies issued by the clubs.