ECB Sets Up Working Group on Access to and Acceptance of Cash

The Euro Retail Payments Board (ERPB) is a high-level strategic body tasked with fostering the integration, innovation and competitiveness of euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More retail payments in the European Union. It was launched in 2013 by the ECB and is chaired by ECB Executive Board Member Fabio Panetta and gathers representatives of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More service providers as well as users of payments services (consumers, merchants, administrations).

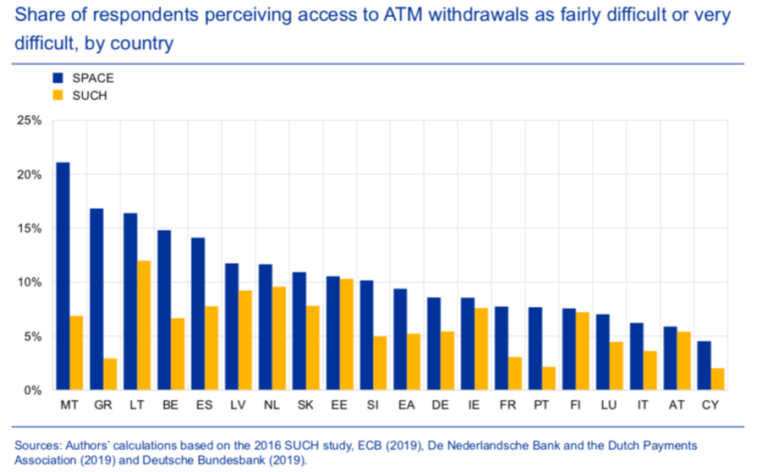

In November 2020, the ECB submitted a paper on access to cashMoney in physical form such as banknotes and coins. More to the ERPB, highlighting that between 2016 and 2019, the number of bank branches declined by 12% and the number of ATMs by 4.3% in the euro area. The ECB 2020 Study on the Payment Attitudes of Consumers in the Euro Area (SPACE) showed that in 2019, almost 10% of respondents considered that access to an ATM is fairly or very difficult, twice the number since 2016. Cash acceptance at the POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More is still high in most euro area countries, but in a few countries, it can no longer be said that cash is universally accepted.

“As euro banknotes and coins are legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More, it is an essential precondition that citizens have good access to them, and that retailers have good cash deposit facilities.” ECB President Christine Lagarde.

The EurosystemThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More has developed a common methodology to measure access to cash based on two metrics – distance to and capacity of cash access points – and a euro-area analysis is being a carried out. Cash access points are currently defined as bank branches and ATMs, as alternative services such as cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More and cash-in-shopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More are considered as complimentary alternatives but not full substitutes.

In February, the ERPB established a working group to analyse access to and acceptance of cash. The Working Group is conducting a stock-taking exercise of various ongoing initiatives by relevant stakeholders and identifying gaps not yet addressed and deserving further investigations and a report is due by November 2021. The report will cover:

- Overview of the factors influencing the bank branch and ATM networks (credit institutions and, where applicable, IADs) and description of possible future initiatives how to avoid cash supply deficits, for example in rural areas;

- Overview of various initiatives aiming at ensuring adequate cash withdrawal and lodgement facilities, especially for smaller and medium sized enterprises (which usually do not contract CITs to take care of cash lodgements/withdrawals and need to rely on “local” cash services);

- Overview of obstacles regarding the acceptance of cash and initiatives aiming to ensure acceptance of cash also in the future; and

- Overview and evaluation of alternative ways where other actors (e.g. retailers, post offices) could offer services to provide access to cash (i.e. cashback, cash-in-shop etc.), including possible obstacles hindering such cash services.

The working group gathers relevant stakeholders, including representatives of ERPB members. The working group is co-chaired by the AGE Platform Europe – a European network of non-profit organisations of and for people aged 50+, which aims to voice and promote the interests of the 200 million citizens aged 50+ in the European Union – and the European Savings and Retail Banking Group (supply side).

Access to cash is being reviewed in an increasing number of countries. In January, the Swedish government has announced a special investigation into the role of the state in the payment market and take position on what the role should look like in the future. In the UK, the Access to Cash Review was launched in July 2018 to look at the future of access to cash across the UK and published its final report in March 2019. In December 2020, the Dutch Central Bank commissioned a study on the cash infrastructure for the medium-term. In France, the central bank along with the treasury is launching an initiative to ensure equal access to cash throughout the territory.