Poland: Cash and Digital Payments

Card Payments: CashMoney in physical form such as banknotes and coins. More vs Digital Transactions

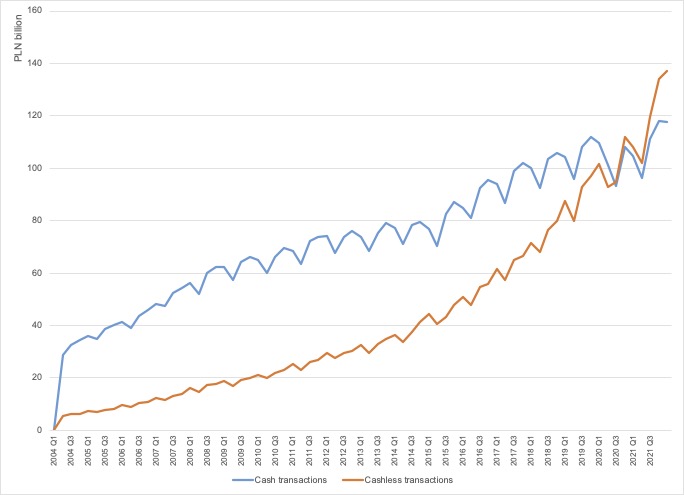

In Poland, digital (“cashless”) transactions with paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More cards overtook cash transactions in Q3 2009. However, it is worth noting that the rapid rise of digital transactions was not the result of a shift from cash to digital, as the volume of cash payments has remained relatively stable since 2004.

By value, cash transactions with payment cards surpassed digital transactions until Q2 2020. Digital payments have significantly expanded during the Covid-19 pandemic. Poland raised the limit for contactless payments from 50 Polish zloty (PLN) to PLN100.

By late 2021, only 6.4% of card transactions involved cash withdrawals and cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More operations, measured by volume. However, by value, 46.2% of card payments involved cash transactions.

Graph 1. Poland: Cash and Digital Transactions with Payment Cards, 2004Q1-2021Q4

B. Value

Note: cash transactions include cash withdrawals in ATMs and bank branches and cashback operations. Source: NBP Payment System in Poland – Payment Cards (Number of card transactions since 1998, Value of cards transactions since 1998).

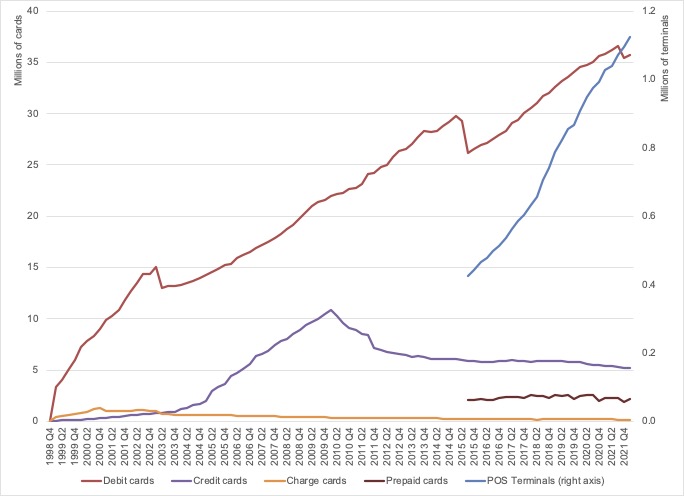

Debit cards dominate card payments in Poland. Their number has grown except for brief periods in 2003, 2013, 2015, and 2021. Credit cards increased until 2010Q2; their numbers have fallen since. Electronic point-of-sale terminals (POSAbbreviation for “point of sale”. See Point-of-Sale terminal. More) grew steadily between 2015 and 2021. There were 35.7 million debit cards, 5.17 million credit cards, 2.21 million prepaid cards, 182,292 charge cards and 1.12 million POS terminals in Poland as of 2021Q4.

Graph 2. Poland: Payment Cards and POS Terminals, 1998Q4-2021Q4

Source: NBP Payment System in Poland – Payment Cards (Number of cards since 1998, Number & value of card transactions at terminals located in the country since 2003).

NBP Protected Cash Payments during the Pandemic

The Narodowy Bank Polski (NBP) has defended the rights of consumers and the unbanked to pay in cash since the beginning of the Covid-19 pandemic. In April 2020, the NBP called all businesses to continue accepting cash in payments. Retail and service outlets’ refusal to accept banknotes and coins meant that “people who use only cash, will not be able to meet their basic needs” such as buying groceries and medicines:

The central bank is concerned about actions of certain market entities aimed to illegally discourage entrepreneurs from accepting cash. Such practices should be condemned, since they cause great difficulties for people who do not have a bank account and use only banknotes and coins as a form of payment. It should be noted that cash may also be the only means of payment for other people in the event of a failure of cashless payment infrastructure.

Financial InclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More in Poland

The NBP’s defence of cash stands in great contrast to other central banks promoting digital payments (such as Egypt, Kenya, Nigeria) and is even more remarkable considering Poland’s financial inclusion levels. According to the World Bank’s Global Findex Database, in 2017,

- 86.7% of Polish people (age 15 and older) had an account at a financial institution.

- 79.3% of Poles owned a debit card, but only 16.5% had a credit card.

- 81.9% of Poles had made or received digital payments.

- 52.4% of Poles used a mobile phone or the internet to access a financial account.

According to the World Bank’s World Development Indicators, in 2020,

- There were 130.4 mobile cellphone subscriptions per 100 Poles.

- 86.8% of the population used the internet.