Cash and Payments in Egypt during the Covid-19 Pandemic

CurrencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in Circulation Grew Nearly 20% between March 2019 and March 2020

At the onset of the Covid-19 pandemic, the Central Bank of Egypt (CBE) sought to reduce cashMoney in physical form such as banknotes and coins. More transactions and promote electronic paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More methods. From March 2020 onwards, the CBE cancelled fees and commissions in points of sales and digital wallets (through September 2020). It also set up a daily cash withdrawal/deposit limit at 50,000 Egyptian pounds (EGP) or USD3,179 from bank tellers for individuals and 20,000 (USD1,271.84) for ATM withdrawals for a limited period.

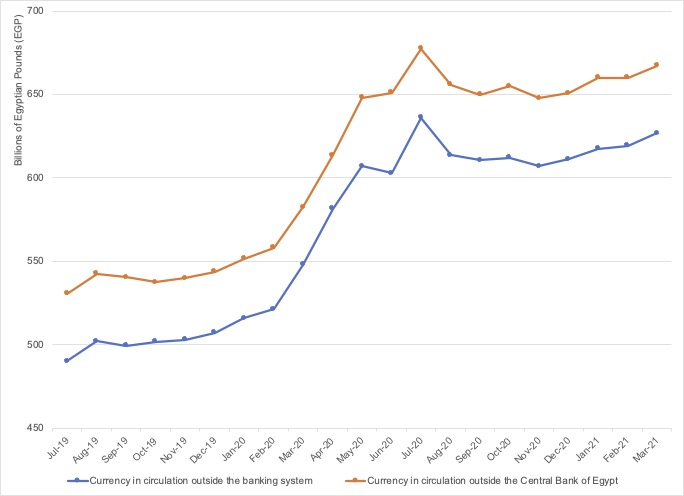

Despite the CBE policies and the acceleration in digital payments, currency in circulation outside the CBE grew 4.37% between February 2020 and March 2020, going from EGP558.11 billion (USD35.49 billion) to EGP582.43 billion (USD37.04 billion), as can be seen on Graph 1. The following month, currency in circulation grew 5.33%. Year on year, currency in circulation outside the CBE grew 19.8% between March 2019 and March 2020, when the World Health Organization (WHO) declared Covid-19 a global pandemic. Egypt joined most countries worldwide where the cautionary demand of cash as a store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More amid a crisis more than compensated for the fall in the transactional demand of cash as a payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More.

Graph 1. Egypt: Currency in Circulation, July 2019-March 2021

Source: CashEssentials, based on CBE Statistics (2021), Domestic LiquidityDescribes the extent to which assets or rights can be converted into cash without causing a significant decrease in the asset’s price. Accordingly, liquidity is often inversely proportional to the profitability of the asset and involves the trade-off between the selling price and the time needed to convert it to cash. In finance, cash is considered the most liquid asset and cash is sometimes used as a synonym for liquidity (e.g. cash reserves; cash pooling…). More and Counterparts and Currency in Circulation Outside CBE series.

A Growing ATM Network

The cash infrastructure expanded in 2020, reflecting the sustained growth in cash usage during the pandemic. Despite its policies to reduce cash usage, the CBE provided banks with 6,500 additional ATMs to “reduce the burdens placed on citizens and branches of banks operating in Egypt.” According to the World Bank’s World Development Indicators, ATMs per 100,000 Egyptians grew from 20.1 in 2019 to 22.1 in 2020.

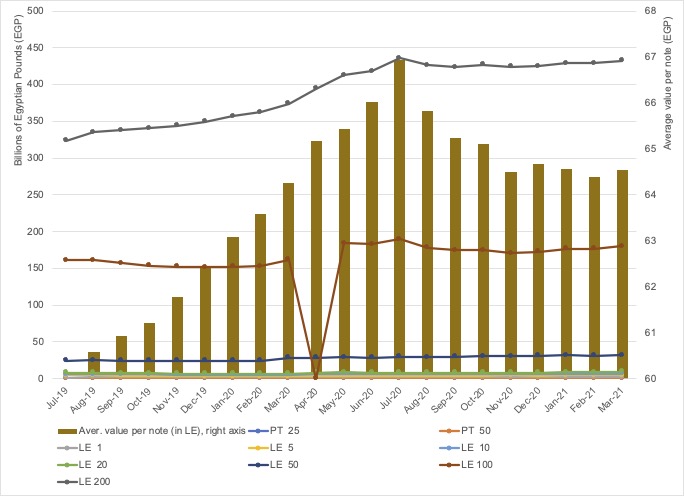

Growth Across Banknotes of High and Small Denominations

Amid higher denominationEach individual value in a series of banknotes or coins. More notes, the amount of EGP100 notes (USD6.36) grew 5.57% in March 2020. The volume of EGP200 banknotes (USD12.72) increased 3.2% in March 2020 and accelerated even further to 5.5% in April 2020.

Regarding smaller denomination notes, the volume of EGP5 (USD0.32) and EGP10 (USD0.64) banknotes increased 4.8% and 11.7% in April 2020, respectively. The level of EGP20 notes (USD1.27) grew 7.04% in March 2020 and 11.71% in April 2020 (Graph 2). The volume of EGP50 notes (USD3.18) rose 14.7% in March 2020.

The average value per note grew from EGP63.58 (USD4.04) to EGP65.18 (USD4.14) between February and April 2020. By March 2021, it had fallen to EGP64.53 (USD4.10).

Graph 2. Egypt: Banknotes by Denomination, July 2019-June 2020

Source: CashEssentials, based on CBE Statistics (2021), Domestic Liquidity and Counterparts and Currency in Circulation Outside CBE series.

CBE Launches PolymerA substrate used in the printing of banknotes, made of biaxially oriented polypropylene (BOPP) polymer. Polymer banknotes were first introduced in Australia and are widely used around the world. More Banknotes

The CBE recently relocated its printing house to Egypt’s new administrative capital. In August 2021, the CBE announced it would launch its first polymer banknotes in early November, starting with the 10- and 20-pound notes.

The CBE’s first version of the plastic 20-pound banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More caused controversy in social media as a watermarkA security feature used on most banknotes. It consists of variations in density and thickness created during the paper production, resulting in variations in their opacity. The combination of these variations forms an image embedded in the paper, which is visible with backlight. Due to its variations in thickness, the watermark also has a raised relief effect. More of the newly-built Great Mosque of Muhammad Ali appeared rainbow-coloured in the released images. The rainbow is a well-known emblem of the LGBTQ+ community.

Regulators Push for Digital Payments and Fintech Solutions

In September 2020, the Egyptian government authorised the CBE to grant banking licenses to fintech firms. This and other changes in the regulatory framework would most likely bring a “big bang in fintech,” according to Mohamed Essam, a fintech specialist at the law office of Matouk, Bassiouny and Hennawy.

In July 2021, Mohamed Omran, chair of the Egyptian Financial Regulatory Authority (FRA), announced that the FRA would prioritise digital payments and fintech solutions to stimulate economic growth and broaden financial inclusionA process by which individuals and businesses can access appropriate, affordable, and timely financial products and services. These include banking, loan, equity, and insurance products. While it is recognised that not all individuals need or want financial services, the goal of financial inclusion is to remove all barriers, both supply side and demand side. Supply side barriers stem from financial institutions themselves. They often indicate poor financial infrastructure, and include lack of ne... More. The government’s Vision 2030 seeks to make Egypt the primary market for digital investments in the Middle East and North Africa region.

In September 2021, the CBE approved contactless payments through mobile phones. In November 2021, the CBE approved regulations to allow users to make instant electronic payments between bank accounts using mobile phones.

World Bank: 77% of Egyptians Have Not Made a Digital Payment

“Egypt is expected to surpass the limitations of a cash society to become the leading power in the world of digital payments within the MENA region, with the fintech industry complementing Egypt’s overall aim to secure financial inclusion,” wrote Mohamed El-Feky, CEO of Sympl, a consumer loans platform.

For fintech firms to meet this goal, they need to overcome significant challenges in the country of 102.3 million inhabitants. According to the latest data (2017) from the World Bank’s Global Findex Database, only

- 32.8% of Egypt’s population age 15 and older had an account at a financial institution,

- 25% of the target population had at least one debit card, and 3.3% had a credit card,

- 22.8% had made or received digital payments,

- 1.8% had a mobile moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More account, and 1.3% used a mobile phone or the internet to access a financial account

According to the World Bank’s World Development Indicators, in 2020,

- 93.2% of Egyptians had mobile phone subscriptions.

- 71.9% of the population used the internet.