Reserve Bank of Australia launches Consultation on the Future Cash Cycle

Cash Use is Changing

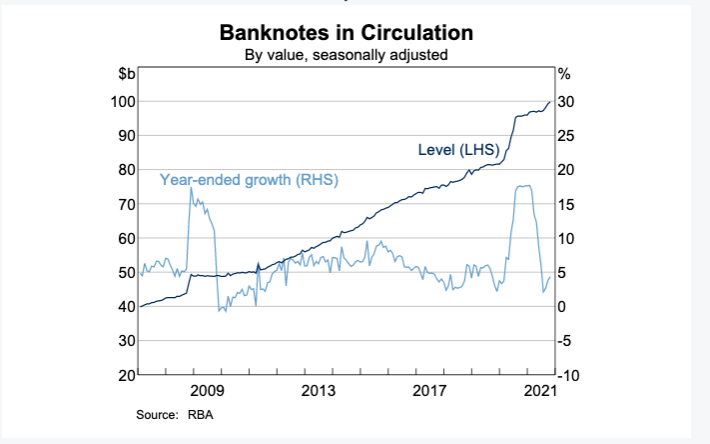

CashMoney in physical form such as banknotes and coins. More use in Australia is changing. Despite the value of currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation continuing to increase, physical cash is being used less as a means of paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More. The chart below shows that banknotes in circulation are about to exceed the AUD 100 billion threshold, more than twice the 2010 level. As in other countries, the pandemic has led to a massive surge of cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More with annual growth rates exceeding 17%.

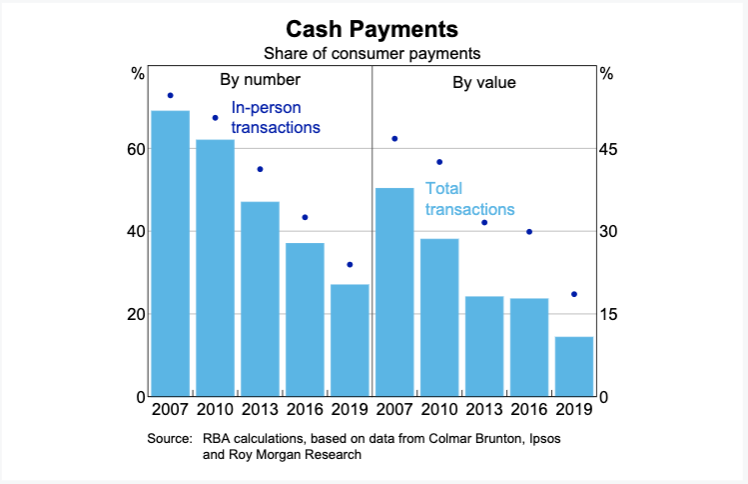

Over the past decade, transactional demand for cash has been declining, with the total share of retail payments made in cash falling from 69% in 2007 to 27% in 2019. This trend has accelerated during the COVID-19 pandemic as people have turned even more to electronic and online payment methods. Nonetheless, cash is expected to remain an important means of payment into the future, particularly as some parts of the community rely heavily on cash in their daily lives.

Cash is also important as a back-up means of payment for electronic payment methods, and as a store of wealth. This applies on a day-to-day basis but becomes particularly important in times of economic or financial uncertainty. In 2020, gigantic bushfires devastated the south-east of the country causing power internet and phone outages and leaving many with cash and their only option to pay for food, water and emergency supplies.

The Current Banknote Distribution System is Under Pressure

The key elements of Australia’s banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More distribution system were established in 2001, when cash was the most commonly used retail payment methodSee Payment instrument. More and have worked well to ensure access to cash for both businesses and consumers. The declining use of cash for retail payments has, however, placed pressure on the current cash distribution system.

The Banknote Distribution Agreements (BDAs) are bilateral agreements between the Reserve BankSee Central bank. More and participating institutions – currently the four major Australian commercial banks. The BDAs provide the legal framework under which the distribution and processing of banknotes in circulation is carried out. Only BDA participants can purchase banknotes directly from the Reserve Bank. They take ownership of the banknotes upon collection from the Reserve Bank’s distribution site.

As an alternative to purchasing banknotes directly from the Reserve Bank, BDA participants are encouraged to purchase surplus banknotes from each other. This is also how organisations that are not party to a BDA are able to obtain banknotes. The exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More and distribution of bulk cash between the four BDA participants is governed by the Australian Cash Distribution and Exchange System (ACDES), which is managed by the Australian Payments Network (AusPayNet).[1]

The distribution of banknotes throughout the country is carried out by the private sector. The BDA participants engage CIT companies to transport, process and store banknotes on their behalf. In order to collect banknotes from the Reserve Bank, these CIT companies must be nominated by a BDA participant and approved by the Reserve Bank (approved CITs). These approved CITs collect banknotes from the Reserve Bank’s distribution site and transport them to their cash depots for distribution to financial institutions and retailers throughout Australia. There are currently four approved CITs that operate around 60 approved depots around the country. There are also a large number of smaller CIT companies operating in the Australian market that are not part of these wholesale arrangements but nevertheless support retail cash distribution.

The BDA participants hold some banknote stocks within Reserve Bank-approved depots to enable them to meet the cash demands of their customers as well as for contingency and risk management purposes. These banknote stocks are known as verified cash holdings (VCH). The Reserve Bank compensates the BDA participants for interest forgone on their holdings of banknote stocks at approved depots, provided the banknotes have been quality sorted and the depots are regularly audited to verify the reported banknote holdings. The interest compensation payment is in line with the interest that would have been earned by the commercial banks were they to instead hold electronic balances at the Reserve Bank.

Options for Future Cash Distribution

The Reserve Bank has released an Issues Paper and is seeking views from interested parties on what changes might be required to ensure that banknote distribution is effective, efficient, sustainable and resilient – both now and into the future. These changes fall under two main categories: addressing excess capacity in the CIT Industry and reviewing the wholesale banknote distribution model.

The RBA proposes three alternatives to address excess capacity in the Cash-In-Transit Industry:

- Improving distribution efficiency, for instance by restructuring depot networks, increasing automation or optimizing vehicle fleets.

- Increasing co-ordination within the system, for instance by sharing routes, infrastructure, or segments of the market. This may require authorisation from the Competition authority.

- Consolidation of the market either through mergers and acquisitions or through the establishment of a utility.

As for changes in the wholesale distribution system, the RBA options include:

- Changing the nature of public sector involvement which could lead to a greater involvement of the RBA, through a NHTO mechanism.

- Reducing quality standards of notes in circulation with the risk of increasing counterfeitThe reproduction or alteration of a document or security element with the intent to deceive the public. A counterfeit banknote looks authentic and has been manufactured or altered fraudulently. In most countries, currency counterfeiting is a criminal offence under the criminal code. More risk and trust in cash.

- Segmenting the BDA to facilitate greater access to banknotes at wholesale level.

Assistant Governor Michelle McPhee said, ‘We are committed to meeting public demand for banknotes so that cash continues to be available to those who want to use it. We place a high priority on the community continuing to have good access to cash withdrawal and deposit services. Having a banknote distribution system that is sustainable in an environment of declining transactional cash use is critical to this goal.’

Australia is joining an increasing number of countries – France, Lithuania, Netherlands, New Zealand, the Philippines, Sweden, UK… – as well as the euro-zone looking at ensuring the future viability and sustainability of cash.