European Council Agrees on a €10,000 Limit on Cash Payments

The European Council agreed on its position on an anti-money laundering (AML)Many jurisdictions have established regulations and set up sophisticated financial and other monitoring systems to enable law enforcement agencies to uncover illegally obtained funds and detect suspicious transactions or activities. International cooperation arrangements have been set up to assist these endeavors. Many anti-money laundering laws combine money laundering (which is concerned with the source of funds) with terrorism financing (which is concerned with the destination of funds) when ... More regulation and a new directive (AMLD6) aimed at protecting EU citizens and the EU’s financial system against terrorist financing. The directive includes a limit on cashMoney in physical form such as banknotes and coins. More payments exceeding €10,000. Member states will have the flexibility to impose a lower maximum limit if they wish.

The directive, when introduced, would significantly strengthen existing anti-money laundering and terrorist financing rules, which require businesses and individuals to apply customer due diligence, including identifying and verifying the identity of the customer as well as the beneficial owner, for transactions in cash exceeding €10,000. Suspicious transactions must be reported to the financial intelligence unit of the EU country.

Cash Payment Limitations Back on the Agenda

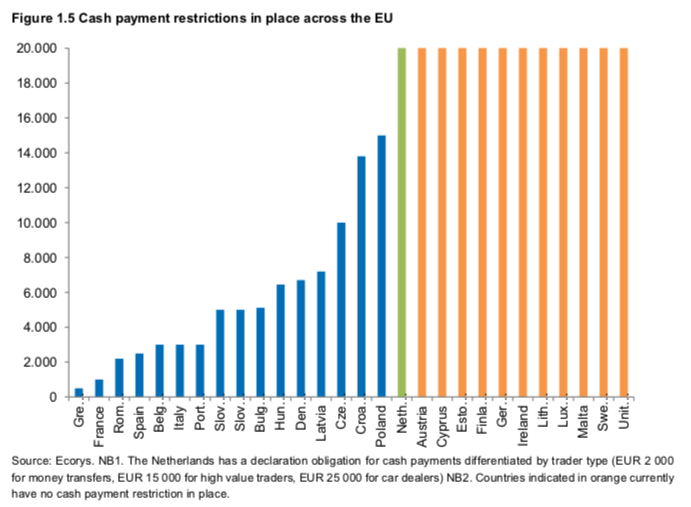

The question of limitations on cash payments has been topical in Europe ever since the Global Financial Crisis. Seventeen out of 27 Member States of the European Union already have cash paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More limitations. With an EU wide-limitation of €10,000, 13 countries would see existing constraints increase. The chart below shows that thresholds vary significantly, ranging from €500 in Greece to over €14,000 in Poland.

In 2018, after a two-year consultation, the European Commission decided not to impose EU-wide limitations on cash payments. The Commission concluded in a report on the impacts of restrictions on payments in cash that “While tax fraud and the use of cash are often associated, the study demonstrates that the relationship between the two is not always clear-cut.”

The European Commission Recommendation 2010/191/EU states that the acceptance of payments in cash should be the rule but acknowledges that cash may be refused for reasons related to the ‘good faith principle,’ without this constituting a breach of the legal tenderMoney that is legally valid for the payment of debts and must be accepted for that purpose when offered. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered (“tendered”) in payment of a debt extinguishes the debt. There is no obligation on the creditor to accept the tendered payment, but the act of tendering the payment in legal tender discharges the debt. More status of cash. The report adds: “[…] the impact of a cash restriction on money launderingThe operation of attempting to disguise a set of fraudulently or criminally obtained funds as legal, in operations undeclared to tax authorities, and therefore not subjected to taxation. Money laundering activities are strongly pursued by authorities and in most countries, there are strict rules for credit institutions to cooperate in the fight against money laundering operations, to declare and report any transactions that could be considered suspicious. More in general, cannot be precisely quantified. In this context, a declaration obligation would already provide law enforcement with intelligence”. It is not clear why the situation is different today.

National vs. EU-Wide Limitations

In a June 2021 interview with Handelsblatt, Johannes Beermann, then Board Member of the Deutsche Bundesbank, was highly critical of the Commission’s plans to impose a €10,000 limit on cash payments. “It is absolutely necessary to intensify the fight against moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More laundering,” he said. “But it is questionable whether an upper limit of €10,000 for cash payments is the most suitable means, or whether it is not primarily aimed at honest citizens.”

Johannes Beermann emphasized: “So far there has been no scientifically sound evidence that the goal of combating money laundering is achieved with upper limits for cash payments.” This has also been shown by experience in countries in which payments with notes and coins have already reached certain sums that are limited. “I therefore consider an upper limit for cash payments to be wrong,” said Beermann.

In December 2022, Italy’s prime minister Giorgia Meloni proposed to lift the legal limit for cash transactions to €5,000, reversing a pledge by previous Italian governments to cut the limit from €2,000 to €1,000 from January 1. Meloni also wants to hand merchants the right to refuse to accept digital payments for transactions below €60 without fear of penalty. In its assessment of Italy’s draft budget plans, the European Commission said the measures to encourage the use of cash breached economic guidelines were “not in line” with past advice to Italy to “fight tax evasion … by strengthening the compulsory use of e-payments”. The advice contradicts the Commission’s 2018 report, which concludes that “the relationship between the two is not always clear-cut.”

It seems likely that imposing limitations on cash payments could further undermine public opinion towards CBDCs as consumers may feel they are forcefully nudged away from cash towards digital money.

In December 2021, a controversial law that would have banned cash payments over $10,000 was voted out by the Australian Senate. Many saw it as infringing on the freedom to use cash and protect one’s financial privacy.

Crypto Assets and Precious Metals are Targeted as Well

The new EU anti-money laundering and combating the financing of terrorism (AML/CFT) rules will be extended to the entire crypto sector, obliging all crypto-asset service providers (CASPs) to conduct due diligence on their customers. This means they will have to verify facts and information about their customers. In its position, the Council demands CASPs to apply customer due diligence measures when carrying out transactions amounting to €1,000 or more and adds measures to mitigate risks about transactions with self-hosted wallets. The Council also introduced specific enhanced due diligence measures for cross-border correspondent relationships for crypto-asset service providers.

Third-party financing intermediaries, persons trading in precious metals, precious stones, and cultural goods, will also be subject to the obligations of the regulation, as well as jewellers, horologists, and goldsmiths.

Now that the Council has agreed on its position on the anti-money laundering regulation and directive, it is ready to start trialogue negotiations with the European Parliament to agree on a final version of the texts.