ATM Withdrawals Are Not a Good Proxy for Cash Payments

The paper (Tanai Khiaonarong, David Humphrey, “Measurement and Use of CashMoney in physical form such as banknotes and coins. More by Half the World’s Population,” IMF Working PaperSee Banknote paper. More 2023/062) argues that using cash for payments is poorly measured. This is undoubtedly true. A better measure of transactional demand for cash would provide policymakers, regulators, and the overall cash community with better data to measure the overall efficiency of the cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More. The paper suggests using ATM cash withdrawals rather than the value of the currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More in circulation.

Firstly, measuring transactional demand is complex due to the anonymity of cash. Secondly, ATM withdrawals are not a good indicator of cash payments because they are not the only channel to obtain cash, and there is no evidence that cash withdrawn from ATMs is used exclusively for payments. Surprisingly, the authors use 2020 paymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More figures and PPP data (see Table 4), which were strongly distorted by the Corona-19 pandemic.

The Challenge of Measuring Transactional Demand

The difficulty of measuring the use of cash for payments results, first and foremost, from the anonymous nature of cash. This anonymity is an intrinsic and essential attribute of cash.

- For Fed Research Fellow Charles Kahn, “Policymakers now fully recognize the importance of privacy considerations in financial infrastructure, including payments arrangements.” The IMF also recognizes the importance of privacy in payments and underlined in a 2018 paper on central bank digital currencies that the ability to make anonymous transactions is an essential criterion for a payment instrumentDevice, tool, procedure or system used to make a transaction or settle a debt. More.

- The Dutch Central Bank writes in “The Role and Future of Cash,” (DNB 2020: 42-43), “Privacy is a constitutional right (Article 10 of the Dutch Constitution). People may prefer anonymity in the case of specific purchases, for example at the pharmacy of when buying a gift.” As a result, we can only estimate the use of cash in payments by using proxies (see for some alternatives Krüger & Seitz, 2014, ch. 2.2).

The monetary theory identifies three motivations for holding cash: transactional, store of valueOne of the functions of money or more generally of any asset that can be saved and exchanged at a later time without loss of its purchasing power. See also Precautionary Holdings. More and international demand. There is no direct measurement of these motivations. They can only be estimated using indirect methods, e.g. by analyzing the denominationEach individual value in a series of banknotes or coins. More mix (large denominations are mainly used as a store of value while small and medium denominations are used primarily to make payments); the lifespan of banknotes (a banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More which is stored will see its lifespan extended in comparison to transactional notes); or seasonal patterns (held notes will dampen the seasonality of demand), etc.

In 2019, CashEssentials hosted a research seminar, bringing together central bank researchers, academics, and payment professionals to strengthen the understanding of cash usage. Several participants shared their analysis of the estimated components of currency in circulation. Table 1 shows that the results vary significantly between countries and that transactional cash, in several cases, represents only a modest part of overall circulation. Therefore, it is incomprehensible why the IMF paper states on p. 6 that “focusing on cash for payments is more important than its other potential uses”.

Table 1. Estimated Components of Currency in Circulation (in %)

Source: CashEssentials (2019).

The IMF paper, on the other hand, breaks down cash in circulationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More into “1) ATM cash withdrawals that are typically used for payments that are known and legal; (2) cash used for hoardingThe term refers to the use of cash as a store of value. However, the term has a negative connotation of concealment, and is often used in the context of the war on cash. See Precautionary Holdings. More, which are not payments and has little circulation; and (3) circulated cash used for unknown transactions involving corruption, tax avoidance, other illegal domestic transactions, and transactions using domestic currency in another country.” Several prominent economists have suggested eliminating high denomination notes to make illegal transactions more complex, including Kenneth Rogoff, a Harvard professor and former chief economist of the International Monetary Fund and Larry Summers, president of Harvard and a Treasury secretary. However, these measures would come at disproportionately high economic and social costs (Rösl et al. 2019; Krüger/Seitz 2017). Moreover, there is little empirical evidence that the shadow economy can explain a large part of cash in circulation (see, e.g., Seitz et al. (2020)). During the Covid-19 pandemic, using cash as a store of value has reached record growth rates not seen since the financial crisis 2008 (Heinonen, 2021). Criminal activity declined then (Nivette et al., 2021), suggesting that the shadow economy does not fuel store of value demand. By using ATM withdrawals, one measures access to cash rather than payments.

ATMs Are But One Source of Cash

The first ATM was unveiled by Barclays Bank in North London in 1967. ATMs have experienced exponential growth since, and according to the International Monetary Fund Financial Access Survey, the number of ATMs worldwide increased from 1,093,780 in 2004 to 2,497,275 in 2021. They have often become the primary source of cash in many countries, but they are not the only source. According to the ECB’s latest study on the payment attitudes of consumers in the euroThe name of the European single currency adopted by the European Council at the meeting held in Madrid on 15-16 December 1995. See ECU. More area (SPACE 2022), 72% of cash is sourced from ATMs in the euro area, with figures ranging from 52% in Germany to 89% in Cyprus (see Graph 1). Other sources of cash include bank branches, cashbackA service whereby the customer pays electronically a higher amount to a retailer than the value of the purchase for goods and/or services and receives the difference in cash. It is also a reward system associated with credit card usage, whereby the consumer receives a percentage of the amount spent on the credit card. More, cash-in-shopService allowing a customer to withdraw cash from a payment account using a mobile application on a smartphone at a participating shop supporting the application. Also referred to as a “virtual ATM”. Unlike cashback, a cash-in-shop transaction does not require the consumer to make a purchase. More, and cash reserves.

Graph 1. Euro area: Sources of Cash Withdrawals, By Frequency of Use and Country, 2022

Source: SPACE (2022)

In Germany, 30% of cash withdrawals are obtained from cash reserves, mainly from previous ATM withdrawals (ECB 2022). This means that ATM withdrawals are used for payment purposes, stores of value, or international motives. In many countries, bank branches no longer handle cash, as illustrated by the chart above. Large withdrawals are carried out at an ATM using a one-shot withdrawal card.

- For Sacha Zackariya, CEO of ChangeGroup, the third-largest foreign exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More retailer in the world, tourists like to carry and pay with cash due to “poor payment infrastructure in their home or destination country, or they may prefer the anonymity of cash. Using cash also lessens the chances of credit cards being cloned, and the danger of identity theft. Many also prefer to hold cash to make quick purchases and for tipping”.

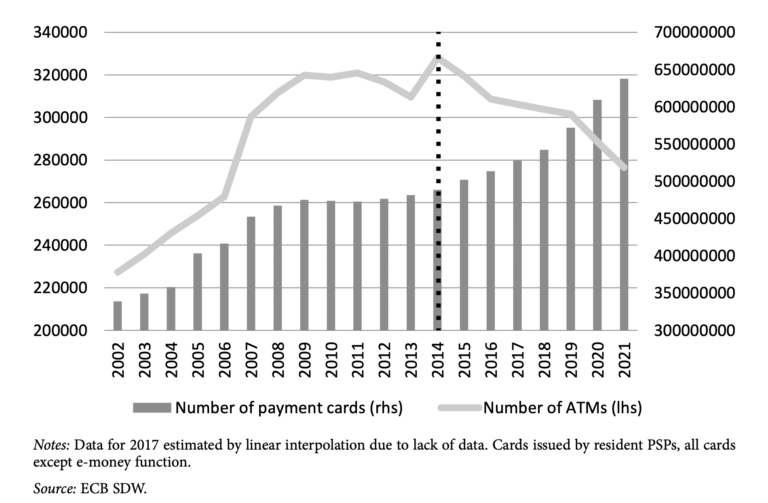

However, the overall number of ATMs has declined from 2,871,623 in 2018 to 2,497,275 in 2021. Should this be viewed as an indication of the decline of cash in payments, or do supply-side factors drive this? The numbers are even more spectacular in the euro area. Over the past 7 seven years, the number of ATMs declined by around 15% from its peak in 2014 of 328,000 units to 277,000 in 2021, as illustrated by Graph 2 below. At the same time, the issuance of payment cards in the euro area grew by 30%.

“As indicated by the dotted line in [Graph 2], the sudden break in both time series after an astounding phase of parallel movements from 2002 to 2014, however, seems to show that consumers were at least to some extent pushed into cashless payments by banks, as these not only made cards and mobile payments more attractive but also actively limited the access to cash by removing ATMs and closing branches.” (Rösl & Seitz, 2022).

Graph 2. Euro area: Payment cards (dark grey, left axis) and ATMs (light grey, right axis) 2002-2021

The SPACE mentioned above study notes that in 5 out of 19 euro area countries, respondents have perceived a worsening trend in the difficulty of withdrawing cash from ATMs.

The Need for Better Data

A growing number of countries recognize that the decline in the use of cash for payments raises significant concerns regarding financial and payment inclusion, the robustness of the payments infrastructure, resilience and stability, and competition in the payments markets. The first step to address this is to measure the cash share in payments better. The measure of the volume of banknotes in circulation is more appropriate as the low and medium denominations are an indicator of transactional demand. In contrast, high denominations are mainly used for precautionary purposes. While some central banks publish this data at a monthly level, the majority only do this every year, and some do not provide it at all.

References

European Central Bank (2022), Study on the Payment Attitudes of Consumers in the Euro Area (SPACE) – 2022, December.

Heinonen, A. (2021) The Paradoxical development of the Usage of Cash During the Pandemic: Part II. CashEssentials.

International Monetary Fund Financial Access Survey.

Kahn, C. “Payment Systems and Privacy” Federal Reserve BankSee Central bank. More of St. Louis Review, Fourth Quarter 2018, pp. 337-44. https://doi.org/10.20955/r.100.337-44

Khiaonarong, T. & D. Humphrey (2023), Measurement and Use of Cash by Half the World’s Population, IMF Working Paper WP/23/62, March.

Krüger, M. & F. Seitz (2014), Costs and Benefits of Cash and Cashless Payment Instruments (Module 1), Study commissioned by the Deutsche Bundesbank, Frankfurt/Main.

Krüger, M. & F. Seitz (2017), The Benefits of Cash (Module 2), Fritz Knapp Publisher, Frankfurt/Main.

Lepecq G. & F. Seitz (2019), Understanding Cash Usage, CashEssentials

Nivette, A.E., Zahnow, R., Aguilar, R. et al. A global analysis of the impact of COVID-19 stay-at-home restrictions on crime. Nat Hum Behav 5, 868–877 (2021).

Rösl, G. & F. Seitz (2022), Central Bank Digital Currency and Cash in the Euro Area: Current Developments and one Specific Proposal, Credit and Capital Markets 55, 535-563.

Rösl, G., F. Seitz & K.-H. Tödter (2019), The Cost of Overcoming the Zero Lower-Bound: A Welfare Analysis, Economies 7(67), 1-18.

Seitz, F., H.-E. Reimers & F. Schneider (2020), Cash in Circulation and the Shadow Economy: An empirical investigation for euro area countries and beyond, Journal of Business & Economic Policy 7(2), 10-30.

Spaandeman J. (2020), The role and the future of cash, De Nederlandsche Bank, Occasional Studies Volume 18 -2

Zackariya S. (2023). Leading Travel and Tourism Retail. Kogan Page.