Poland: Cash Circulation, Infrastructure and Withdrawals

Cash in CirculationThe value (or number of units) of the banknotes and coins in circulation within an economy. Cash in circulation is included in the M1 monetary aggregate and comprises only the banknotes and coins in circulation outside the Monetary Financial Institutions (MFI), as stated in the consolidated balance sheet of the MFIs, which means that the cash issued and held by the MFIs has been subtracted (“cash reserves”). Cash in circulation does not include the balance of the central bank’s own banknot... More

CashMoney in physical form such as banknotes and coins. More remains the most frequently used payment methodSee Payment instrument. More in Poland. According to the “PaymentA transfer of funds which discharges an obligation on the part of a payer vis-à-vis a payee. More habits in Poland in 2020” study, 97.8% of respondents said they prefer to use cash in payments (NBP 2020: 8-9). Poland’s cash payment limitations are less restrictive than other European Union members states. Cash on delivery is a popular payment method in the country.

- Poland’s currencyThe money used in a particular country at a particular time, like dollar, yen, euro, etc., consisting of banknotes and coins, that does not require endorsement as a medium of exchange. More circulation has grown almost continually between December 1996 and February 2022, except for a 12% decline in January 2000, following a sharp hike in anticipation of Y2K.

- Currency in circulation expanded more rapidly during the Covid-19 pandemic. Data from the Narodowy Bank Polski (NBP) shows that cash in circulation grew 11.6% between February and March 2020. Currency in circulation in January 2021 was 38.9% larger than in January 2020.

- The NBP reassured the public about the supply of cash at the time. “There is no risk of running out of cash. Currently, it is delivered to commercial banks on an ongoing basis, nationwide, without any delays or restrictions. Due to increased cash withdrawals, in some places, there may be temporary delays in the supply of cash from the logistic centres of commercial banks and cash-handling companies, but there is no question of permanent problems,” said NBP governor Adam Glapiński.

Graph 1. Poland: Currency in Circulation, December 1996-February 2022

Note: Series excludes cash in monetary financial institutions’ vaults. Source: NBP Monetary and Financial Statistics, (M3 and its counterparts – balance sheetA piece of paper or substrate of 800 mm by 700 mm, on which banknotes are printed. The “sheet to sheet” printing technique is the most widely used in printing of banknotes, but the roller printing technique also exists. More format).

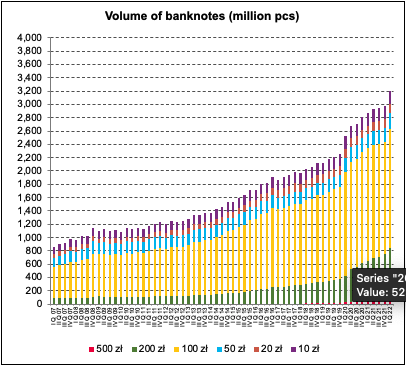

Structure of Cash in Circulation

The value of banknotes and coins in circulation in Poland equalled 389.4127 billion Polish zloty (PLN) during the first trimester of 2022, according to NBP data. The banknotes with the most pieces in circulation are the PLN100 (with 55.97% of Polish banknotes), and the PLN200 (24.12% of all banknotes).

The PLN500, the highest denominationEach individual value in a series of banknotes or coins. More banknoteA banknote (or ‘bill’ as it is often referred to in the US) is a type of negotiable promissory note, issued by a bank or other licensed authority, payable to the bearer on demand. More launched in 2017, comprises just 2.06% of Polish banknotes. The dominant coins are the 1-grosz (37.49% of all coins) and the 2-groszy (16.55% of Polish coins).

The PLN100 and the PLN200 banknotes grew the most during the Covid-19 pandemic. Like other countries worldwide, an increase in Polish consumers’ precautionary demand for high-denomination banknotes more than compensated for the decline in their transactional demand for cash.

Graph 2. Poland: Structure of Banknotes in Circulation, 2007Q1-2022Q1

Note: Series excludes cash kept in NBP’s counters and vaults, cash owned by NBP and deposited in commercial banks’ vaults, and cash unfit and withdrawn from circulation by NBP. Source: NBP Monetary and Financial Statistics (Banknotes and Coins).

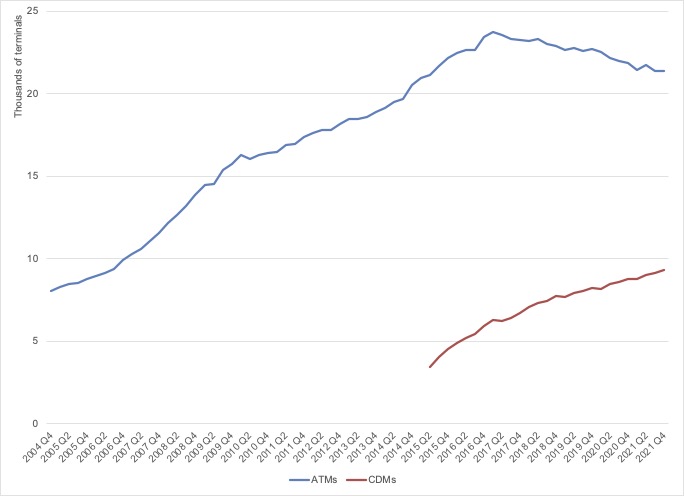

The Cash Infrastructure: ATMs and CRMs

In 2016, Poland and Turkey were the only two European countries with a growing ATM base. The number of ATMs in Poland expanded from 8,054 in 2004Q4 to 23,751 in 2017Q1. Poland’s cash terminals have declined since then, albeit slowly. Poland had 21,396 ATMs as of late 2021. Cash RecyclingThe process of converting waste materials into new materials and objects. Banknotes are increasingly recycled after destruction, and the waste is often used for landfills, isolation material etc. Polymer notes are melted into pellets which are recycled into new products. Recycling is often incorrectly used instead of recirculation. See Recirculation. More Machines (CRMs) grew from 3,468 in 2015 Q2 to 9,343 in late 2021.

Graph 3. Poland: ATMs and CDMs, 2004Q4 -2021Q4

Note: ATMs: automated teller machines; CDMs, cash deposit machines. Source: NBP Payment System in Poland – Payment Cards (Number of ATMs. Value and volume of AT transactions since 1999).

In 2015, Poland’s Idea Bank launched a fleet of electric cars fitted with ATMs. A year later, Idea Bank’s fleet had grown to 18 mobile ATMs in 12 cities: “One in three Polish micro-entrepreneurs accept only cash payments, and almost four out of five deliver income to their bank in person. By providing them with a convenient and secure way of depositing moneyFrom the Latin word moneta, nickname that was given by Romans to the goddess Juno because there was a minting workshop next to her temple. Money is any item that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular region, country or socio-economic context. Its onset dates back to the origins of humanity and its physical representation has taken on very varied forms until the appearance of metal coins. The banknote, a typical representati... More, we have made their day-end business closing much easier,” said Dominik Fajbusiewicz, board member of the bank.

Cash Withdrawals

Cash withdrawals by volume grew from 2004Q4 to 2014Q2, declining after that. Their worst fall occurred in 2020Q2, coinciding with the emergence of the Covid-19 pandemic. By value, cash withdrawals grew from 2004Q4 to 2019Q3.

Graph 4. Poland: Cash Withdrawals by Volume (Millions of Transactions, left axis) and Value (PLN billion, right axis), 2004Q4 -2021Q4

Note: ATMs: automated teller machines comprise terminals offering only cash withdrawals and recyclers. CDMs: cash deposit machines include terminals offering only cash deposits and recyclers. Source: NBP Payment System in Poland – Payment Cards (Number of ATMs. Value and volume of AT transactions since 1999).

Polish consumers used ATMs less during the pandemic, but they withdrew the same or even more cash as before. The NBP thanked “professional cash cycleRepresents the various stages of the lifecycle of cash, from issuance by the central bank, circulation in the economy, to destruction by the central bank. More participants for their commitment to ensure that society has uninterrupted access to cash.” Increased cash withdrawals “were not made for the purpose of executing transactions, particularly in the initial period of the epidemic, but primarily for value storage and precautionary purposes, resulting from bank customers’ concerns about the crisis situation” (NBP 2020: 2).

Converting Hryvnia to Zloty

Per the NBP, currency in circulation rose 11% in February 2022 because of “unprecedented withdrawals” that caused “problems with the availability of cash in ATMs” in the first weeks of the Russian invasion, reported the Financial Times. The increase results from the public’s dash for cash amid uncertainty and the exodus of refugees fleeing the war in Ukraine.

Poland has received more than 2.1 million Ukrainian refugees since the Russian invasion began February 24. Many refugees left in haste, often carrying funds in cash. On March 8, the National Bank of Ukraine (NBU) urged refugees to “deposit their hryvnia cash into their card accounts in Ukraine rather than moving it out of the country as they leave.”

- “The biggest problem people are having is that they are arriving with [Ukrainian] hryvnia and they cannot changeThis is the action by which certain banknotes and/or coins are exchanged for the same amount in banknotes/coins of a different face value, or unit value. See Exchange. More them… because the exchange rateThe rate at which one currency will be exchanged for another. More is wild,” said Olga, a Ukrainian volunteer helping refugees arriving at Warsaw’s main train station.

- “We are aware that [Ukrainian refugees] are experiencing difficulties in exchanging cash, and indeed many crossed borders with cash only,” said one EU official.

- “In cashless payments, conversion rates are much better than the black-market exchangeThe Eurosystem comprises the European Central Bank and the national central banks of those countries that have adopted the euro. More rate for cash,” said NBU deputy governor Oleksii Shaban.

On March 18, the NBP and the NBU agreed on a mechanism to enable Ukrainian refugees to exchange Ukrainian hryvnia (UAH) for Polish zloty (PLN) at the “rounded, official exchange rate (and not the one offered by exchange offices).” Starting on March 25, Ukrainian refugees could exchange up to UAH10,000 in selected branches of PKO Bank Polski, the largest Polish bank.

- “Many representatives of the brave Ukrainian nation fleeing the criminal military aggression have come to Poland. Often they have only hryvnias with them (taken in haste), which so far they have been unable to exchange for zloty. […] I am very pleased with the regulation of this very important issue for the refugees,” said NBP Governor Adam Glapiński.

- “Thanks to the agreement, Ukrainians will be able to exchange their hryvnia cash in Polish banks in order to cover their needs. We are grateful to our colleagues for taking this humanitarian step that will strengthen partnership between our nations”, said NBU Governor Kyrylo Shevchenko.

Over three days, more than 13,000 Ukrainian citizens exchanged their hryvnias. No participant charged exchange fees. NBP will resell the purchased hryvnias to the NBU at 0.14 PLN per 1 UAH.